A new COVID variant with a creepy sci-fi name is gaining notoriety in the seemingly endless pandemic. It should be noted, though, that virus-weary consumers aren’t taking this latest strain lying down… in pajamas… or loungewear. No, they’re trying to enjoy the holiday season and all it has to offer while embracing the familiar comfort of denim. However, the reasons behind denim’s appeal vary from country to country, and that can affect how marketers may want to position this iconic staple.[quote]

Nevertheless, some things are universal and, as WGSN points out in a recent Insider report on key spring ’22 denim trends, consumers are looking for versatility and enduring style, making classic denim an essential wardrobe piece.

“Items will offer a timeless range, with an eye toward considered consumption, all with practical features top of mind,” reads the WGSN report.

Euromonitor International projects a 9 percent global upswing in denim jeans purchases, to $106 billion by 2024. China is also poised to become the largest consumer of denim apparel by 2023, according to Euromonitor data.

But unlike in Western countries like the U.S., which have a “denim as workwear” heritage, Chinese consumers wear jeans as a fashion item, with fairly short wardrobe lifecycles driven by trend and seasonality, according to research in the recently released Cotton Council International (CCI) and Cotton Incorporated 2021 Global Denim Study (November 2021). Fully 61 percent of Chinese consumers shop for denim to keep up with the latest trends. Among 25-to-34 year olds, that number jumps to 72 percent. A portion of China’s denim shoppers (34 percent) say they like to add new styles to their wardrobes such as wide-legged or flare silhouettes.

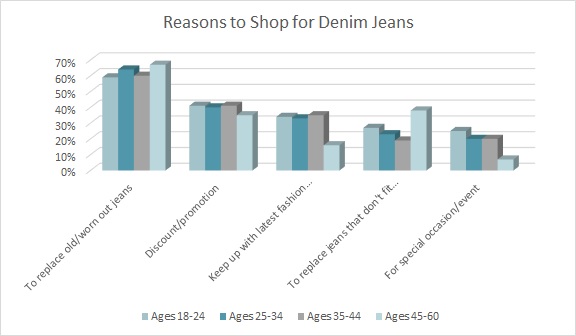

Meanwhile in the U.S., consumers purchase jeans for more pragmatic reasons, according to the CCI and Cotton Incorporated 2021 Global Denim Study (November 2021). Americans predominantly buy new jeans to replace pairs that are old/worn out (63 percent). After that, they’ll buy if there’s a discount or promotion (39 percent), followed by a desire to keep up with the latest trends (29 percent). Attributes such as fit (84 percent), comfort (83 percent), durability (80 percent), and quality (79 percent) are the top features U.S. shoppers seek when shopping for new denim jeans.

The story differs yet again in Mexico, where consumers own 16 pairs of jeans, on average, according to the CCI and Cotton Incorporated 2021 Global Denim Study (November 2021). Compare that to 10 pairs owned by U.S. shoppers and 11 pairs for Chinese consumers.

There’s also an abundance of product at competitive prices as well as access to quality jeans from both local and international brands. Like U.S. shoppers, Mexicans are pragmatic and mainly buy new product to replace existing jeans that are old/worn out (63 percent). That’s followed by buying when there’s a discount or promotion (37 percent). But compared to U.S. consumers, Mexicans have a bigger interest in keeping up with trends (35 percent).

As for styles, consumers have at least one surprising preference — and it’s right here in the U.S. Earlier this year, Gen Z took to TikTok to give Millennials a hard time about skinny jeans and side parts in their hair. But get this: In the United States, slim (40 percent) and skinny styles (36 percent) are still the preferred silhouettes among 18-to-24 year olds, according to the Global Denim Study. In fact, they like them more than their older counterparts who reach for slim and skinny styles (both 25 percent) significantly less than the Gen Z crowd. Overall, though, more comfort-focused jeans are catching on, as 38 percent prefer straight leg jeans, followed by relaxed (33 percent), classic/regular (32 percent), and bootcut (26 percent). Just 14 percent opt for boyfriend jeans and even fewer (12 percent) prefer wide-leg styles.

Consumers in the U.S. also prefer denim jeans that are made of cotton (79 percent), according to the Global Denim Study. Americans feel cotton denim jeans are “more authentic” (67 percent), as opposed to jeans made with manmade fibers like polyester (19 percent). Denim buyers in the U.S. also prefer cotton denim jeans because they feel it’s the most authentic (67 percent), softest (66 percent), highest quality (65 percent), lasts the longest (62 percent), and is most comfortable (62 percent).

Further, U.S. shoppers say knowledge about the use of natural fibers (57 percent) and “more sustainable production” (59 percent) would impact their purchase of denim jeans, according to the Global Denim Study. Brands that support groups like the Better Cotton Initiative (BCI), which promotes higher standards in cotton farming and practices across 21 countries, stand to benefit, especially among consumers who are looking to buy less, but better-quality garments.

In Mexico, half the shoppers (50 percent) prefer skinny jeans, driven in large part by 18-to-34 year olds (61 percent), according to the Global Denim Study. However, the pandemic drove an increasing interest in styles like the relaxed fit (55 percent), boyfriend cut (48 percent), wide leg (48 percent), and flare jeans (39 percent).

Fully 84 percent of Mexican consumers prefer their jeans be made of cotton, according to the Global Denim Study. They consider it the softest (87 percent), highest quality (84 percent), most comfortable (83 percent), most trustworthy (80 percent), most breathable (80 percent), and longest lasting (76 percent). The study also found Mexican respondents seek functionality and intelligent fabrics that work hard on a daily basis. They are more likely to seek out denim that holds its shape (76 percent) or uses fabric technology that allows the denim to mold to their shape (71 percent). To that end, Mexican consumers also found that compared to denim jeans made of manmade fibers, cotton jeans are the most versatile (60 percent) and innovative (55 percent).

And in China, nearly three-quarters of all consumers (76 percent) prefer cotton in their denim jeans, according to the Global Denim Study. Their favorite styles are classic/regular (44 percent), followed by relaxed (42 percent), straight (42 percent), and slim (33 percent). Looser styles like boyfriend (13 percent), flare (11 percent), and bootcut (9 percent) ranked lower in preference.

Chinese consumers’ top denim concerns center around comfort (92 percent), fit (92 percent), and quality (88 percent), according to the Global Denim Study. Whether jeans are durable (45 percent) and long lasting (38 percent) also grew in importance for consumers in China, while almost one-third (27 percent) showed increased interest in denim made of cotton, suggesting a shift toward more considered purchasing when it comes to denim jeans.

In a comparison of jeans made of cotton and manmade fiber jeans, Chinese consumers consider cotton denim to be most authentic (74 percent), most trustworthy (74 percent), softest (74 percent), and most comfortable (73 percent), according to the Global Denim Study. Brands that marry fashionable denim with consumers’ desire for durable, comfortable jeans stand to win in the Chinese market.

WGSN says timeless styles, conscious design and generously cut “easy to wear” jeans are the key denim trends for 2022.

“Refocus attention away from fast-fashion trends or trend for trend’s sake,” the forecasting firm states, “and invest time in simplifying and curating core styles with quality materials and fits.”