The average parent is always looking for deals but perhaps even more so this Back-to-School (BTS) season, due to worries about rising costs and growth. This means retailers should expect shoppers scoping out sales and promotions, yet still seeking value and transparency with their apparel purchases. This means retailers should expect shoppers to be scoping out sales and promotions, yet still seeking value and transparency with their apparel purchases.

About half of Back-to-School families said they’re shopping earlier specifically because they’re worried tariffs will make things more expensive later in the season.

Katherine Cullen, vice president of industry and consumer insights, National Retail Federation

Akeneo’s Romain Fouache, CEO of the product information company, told the Lifestyle Monitor™ in an interview that consumers seem to be more prudent this year than in the past.

“We’re seeing people much more cautious about how and where they spend,” Fouache told the Monitor™. “I recently read that about three-quarters of consumers are ready to switch brands for price, when last year, it was two-thirds. So, to go from 66 percent to 75 percent we’re definitely seeing an increase of price sensitivity. Price is taking a more central place in the decision process than before. That being said, we are also seeing a consumer that is actually more informed about the differences in products. We are seeing way more attention to things like the country of origin, more attention to what might be said about the products on social networks. So, it’s price to value that’s really being impacted.”

The National Retail Federation (NRF) expects families with students in elementary through high school to spend an average of $858 on clothes, shoes, school supplies and electronics this BTS season. That’s down from $875 in 2024. Despite families spending less, the NRF says more families will be making back-to-school purchases, driving spending up from $38.8 billion last year to $39.4 billion this season.

The NRF’s Katherine Cullen, vice president of industry and consumer insights, said in a webinar that 67 percent of consumers began their BTS shopping in July this year compared to 55 percent in 2024, so they could spread their spending over several paychecks.

“They are starting to see potentially higher prices due to inflation and it’s shifting their behavior,” Cullen said. “About half of Back-to-School families said they’re shopping earlier specifically because they’re worried tariffs will make things more expensive later in the season.”

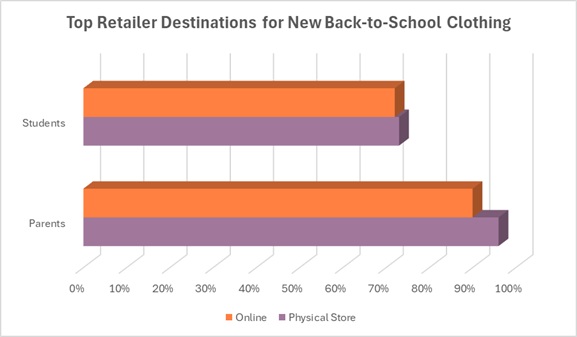

That sentiment is also affecting where parents plan to buy their BTS clothes. While 96 percent say they will do their shopping in a physical store, 80 percent plan to shop at mass merchants and 61 percent expect to shop at off-price stores, according to Cotton Incorporated’s 2025 Back-to-School Supplemental Survey (n = 1,011). Parents also expect to shop online (73 percent), where they plan to shop on Amazon (80 percent) and the online platforms of brick-and-mortar stores (71 percent). Another 37 percent say they will head to second-hand stores for their BTS apparel needs.

When it comes to purchase drivers in their kids’ clothes, parents are looking for comfort (72 percent), quality (70 percent), and durability (55 percent), according to the 2025 Back-to-School Survey. Their kids are also looking for comfort (73 percent). But they put trendy styles (57 percent) ahead of quality (63 percent) and durability (32 percent).

Students say they primarily want to wear T-shirts (46 percent) and hoodies (17 percent) as their tops, according to the 2025 Back-to-School Survey. And they are evenly split on bottoms, seeking leggings, sweatpants/joggers, and denim jeans (all 33 percent). The majority of parents say they want the T-shirts and hoodies to be made of cotton. Additionally, 82 percent of students say they prefer cotton because it’s comfortable.

Some of the biggest mass merchants and discounters are ready for the BTS surge with choices that should tick all the boxes as far as trendiness, comfort and natural fibers like cotton. TJ Maxx has a whole online Back-to-School online shop, where parents can find name brand and designer dresses, denim, shorts, hoodies, and more.

Walmart, Target, and Children’s Place have shoppers covered for both price and natural fibers for the kids, ranging from 100 percent cotton dresses for toddler girls to licensed tees to denim for teens. The retailers also offer a mix of cotton-rich pieces for school uniforms, including tagless polo shirts, scooter skirts, and pants.

“If your child is sensitive to certain fabrics, choose softer materials like 100 percent cotton, which is less likely to irritate their skin,” Walmart advises visitors to the back-to-school/school uniforms page of its website. “If your child is tough on clothes, it might be worth it to invest in pants with double-layered knees and double-stitched seams. This choice can save you from having to buy new uniforms before the year is over.”

Of course, it’s important for stores to remember how much “kidfluence” the students have on BTS shopping, especially since it changes as students age. Among 3-to-5 year olds, just 23 percent of children influence purchases, according to the 2025 Back-to-School Survey. That increases to 32 percent among 6-to-9 year olds, then leaps to 46 percent among 10-to-14 year olds. By the time kids reach 15 years old, the majority (54 percent) are influencing the school clothing purchases.

“Kids have a significant influence as they age,” Fouache told the Monitor™, “especially as they get more exposed to social networks, there’s definitely an influencing vibe. And that’s when kids play a strong role in steering some of the purchasing decisions.”

To help parents and students find what they need, the experts said its crucial stores have their employees fully prepared to help in-store, where most apparel purchases are made. Dave Bruno, director of retail industry insights at Aptos, a global retail technology company, says it’s critical salespeople are armed with inventory visibility.

“The more people who can see how many items you own and where you own it, the more people who can sell it,” Bruno told the Monitor™ in an interview. “If necessary, they need the ability to actually sell it from the secondary location, and for that location to be able to fulfill the order. Ensuring the shipping store is alerted of the order and the need to ship the desired size is obviously a must-have part of the process. Finally, putting these capabilities in the palm of every associate’s hand on a mobile device ensures they can help each customer find the products they need whether they are in the aisle, the fitting room or anywhere else throughout the store.”

Fouache agrees, saying the stores that will do best are those that train their sellers to provide a better in-shop experience than a customer would have online. This is especially important, he says, as consumers are looking for both price and value.

“Consumers are now really paying attention to what they’re paying, and how they’re paying,” Fouache said. “Make sure you can articulate your product in the best way possible. It’s essential to do that on all your channels, from influencers to online to brick and mortar shops. You need to convey the full story about your products, and to have it conveyed as much by your online shop as by your in-store seller. This way people can understand what they’re paying, why it’s actually worth that and then potentially building loyalty that will help you go the extra miles in terms of the sales you can make with them.”