The coronavirus had people indoors and bingeing Netflix for so long, they probably saw more than one old movie like “Mean Girls” that captured a mall scene of yesteryear: crowded stores, escalators and food courts, and most people carrying shopping bags. That’s a stark difference from the spooky scene malls experienced in the days COVID-19 forced stores to shutdown nationwide. As states and non-essential stores continue to open, retailers recognize they have a huge hurdle to overcome, and they’re turning to technology to help coax the consumer back.[quote]

First Insight polled consumers about their feelings around safety when visiting stores and found that most (54 percent) would feel safest in a grocery store, followed by a drug store chain (50 percent), big box retailer (45 percent), and local small businesses and warehouse clubs (43 percent). Just 33 percent of respondents said they would feel safest shopping in a mall. The firm also found that 65 percent of women and 54 percent of men said they wouldn’t feel safe trying on clothes in dressing rooms.

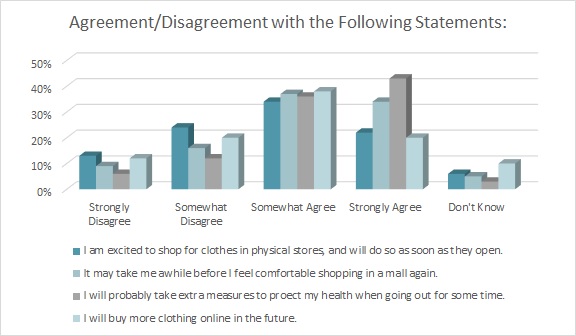

The threat of the coronavirus led to nearly 8 in 10 shoppers (79 percent) saying that for some time they expect to take extra measures to protect their health when going out, e.g., face masks, hand sanitizer, according to the Cotton Incorporated 2020 Coronavirus Response Survey (Wave 2 April 27-30). Further, 71 percent of respondents say it may take them a while before they feel comfortable shopping in a mall again.

Perch Interactive, the retail marketing and analytics software firm, also makes interactive displays and kiosks. The firm has been considering how stores and brands could better connect with consumers in a world where engagement is strained. Trevor Sumner, CEO, said apparel sales dropped 86 percent since quarantining began, making consumer connection all the more vital. Perch, whose customers include Macy’s and Neiman Marcus, helps engage customers in-store with its digital touchscreens. Yes, touchscreens.

“Right now, I think we’re still operating in a touch-phobic world,” Sumner said in a recent webinar, “The Reality of Reopening, How Technology is Enabling the Reopening of Brick and Mortar Retail. “We’re still trying to encourage safe touching of product, of screens, of all these things.”

Sumner says stores that use digital signage will discover their top provider content is video ratings and reviews, so that information should be brought up to the first screen for consumers who don’t want to touch a digital screen. Stores and brands can also update their messaging in real time, and augment what would have worked in a pre-COVID world to a COVID world.

Stores and brands can also incorporate a QR code into their marketing, Sumner says. The QR code could be posted on the digital signage and then scanned by the consumer simply by opening the camera on their phone. COVID-era shoppers might prefer to use the QR code on their own phone rather than make contact with the surface of the touchscreen because it’s viewed as cleaner and safer. Once the QR code opens to the brand’s screen, shoppers could be presented with a variety of store promotions or sales, an in-store discount on a particular category, a video about the brand or an opportunity to make contactless payment.

More than 6 in 10 shoppers (61 percent) say they’ve discovered new ways to shop during this pandemic, according to the Coronavirus Response Survey research. And about 70 percent say this experience will change the way they shop in the future.

Sumner says sensor networks will enable optimization of product engagement and shopper behavior. Its sensory motion technology allows the company to get consumer information while the consumer is hovering over an item to get information about the product. This, too, will help grow contactless payments, he says.

“I think a lot of people are flying blind or flying based on fear or personal experience about what shoppers are or aren’t doing in store,” Sumner says. “And one of the things about having a product engagement marketing platform is being able to see the stuff in real time. As we looked at our platform, we determined it’s really about [the consumer’s] product consideration and adding to the cart. So we’re looking at browsing behavior and how digital impacts product pickup. And we’re looking to leverage our analytics to really monitor changing buyer behaviors during COVID-19. We are detecting every product- or screen touch that’s going on. We can see which products are surging or falling in real time, where there are product shortages preventing sales. We can see how shoppers are interacting with digital content and how that’s changing. It’s really critical to have this ability in-store.”

When the current pandemic passes, almost 3 in 10 consumers (29 percent) say they will have a stronger preference for clothes shopping in a brick and mortar store, according to the Coronavirus Response Survey research. Another 23 percent say they’ll prefer online shopping. But 40 percent say their preferences will remain the same.

Euromonitor International‘s Michelle Evans, senior head of digital consumer, says the pandemic has ensured technology will be “interwoven with commerce henceforth.” In her report, “The Retail Ecosystem During COVID-19,” an extract of “The Impact of Coronavirus on Retailing,” study, Evans says growth will likely be seen in cloud computing, which allows for more flexibility in business. The industry should also expect to see a larger role for robotics, since their usage would increase speed — and reduce human contact in areas like manufacturing and distribution. Additionally, the Euromonitor study says apparel brands and retailers should expect to see growth in artificial intelligence, the Internet of Things, augmented- and virtual reality, blockchain, and GPS tracking.

Paula Rosenblum, co-founder and managing partner at Retail Systems Research (RSR), says stores and brands don’t have a lot of choice if they want to comply with local regulations, stay safe and squeeze maximum top and bottom lines in what is still a very uncertain time. She says sophisticated workforce management technology is vital going forward, especially because it keeps track of where COVID-19 outbreaks are occurring, allowing management to organize the workforce differently in those locations.

Rosenblum also says stores will likely accelerate the trend of trying new types of stores, “From dark stores for ‘fulfillment only’ to pop-up stores, to stores with broader assortments to facilitate one-stop shopping,” she says. “Not all these models will be successful. It seems very important, especially in times where earnings and revenue are likely going to be scarce, to identify as quickly as possible how well these formats are working and either abandon or expand them.”

Rosenblum says she generally doesn’t believe in solving a business problem solely with technology.

“This time it’s different,” she states. “Along with compassion, empathy and compliance, the industry really needs to get faster and smarter. Economic survival demands it. And technology can most certainly help.”