If one thing defines the holiday outlook this season, it’s “uncertainty.” While some outlets expect consumers to spend more, others are predicting a decrease. One thing that remains steady is the expectation that apparel will be a top gifting item. But experts say brands and retailers need to offer the best value – not necessarily the least expensive items – this year.

Shoppers have a lot more weighing on their minds and wallets this year, and they aren’t taking any chances.

Romain Fouache, CEO, Akeneo

“Apparel remains one of the top items consumers plan to purchase this holiday season,” said Circana’s Kristen Classi Zummo, apparel industry advisor at the global market research and tech company, in an interview with the Lifestyle Monitor™. “Value is the key purchase driver – whether that’s reflected in the best sale price, free shipping or quality. Price alone won’t spark interest; it’s the right balance of the value equation that will win over shoppers this season.”

Romain Fouache, CEO of Akeneo, a product experience company, also feels apparel will prevail this season, but adds a caveat.

“Apparel will likely continue to be a top holiday gift,” Fouache told the Lifestyle Monitor™ in an interview. “But consumers will undoubtedly alter how and where they go about making those purchases. In an era of tariffs and global trade wars, brands can’t rely on low prices as a crutch – the model is eroding under scrutiny. Value, especially for apparel, will be less focused on price alone, and more on what you get for what you pay. And in times of economic uncertainty, that will mean storytelling, substance, and most importantly, transparency.”

When shopping for apparel gifts this holiday, most consumers (65 percent) say they will be looking for cotton clothing, according to the Cotton Incorporated 2025 Lifestyle Monitor™ Survey. The survey completes 500 interviews per month with U.S. consumers between the ages of 13 and 70. Following cotton are denim (6 percent), polyester (3 percent), silk, linen, wool, and nylon (all 1 percent).

At 55 percent, tee shirts top the list of clothing items consumers say they wish to receive this holiday, according to the Monitor™ research (among 348 surveyed consumers). Men are much more likely to want T-shirts than women (69 percent versus 46 percent). Meanwhile, 52 percent of women want sleepwear like robes, pajamas, or nightgowns compared to just 27 percent of men. Sweaters (42 percent) are also a top holiday item, along with jeans (36 percent), casual shirts (36 percent) and outerwear (35 percent). Both men and women would also like athletic apparel like yoga pants and running shorts or shirts (34 percent). And the old standby – socks – are sought by 33 percent.

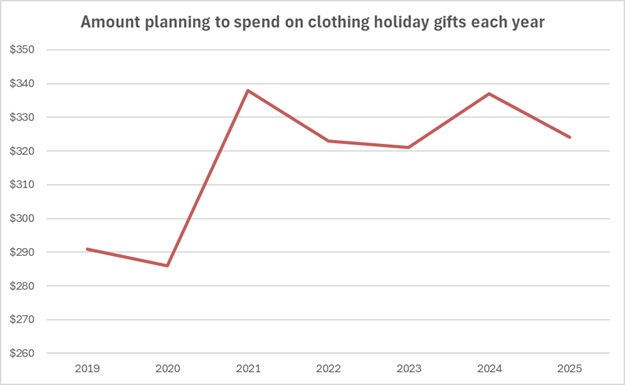

Overall, consumers surveyed by the Lifestyle Monitor™ plan to pull back on spending this year, saying they plan to spend an average of 6 percent less this holiday: $796 this season, down from the $844 in 2024. This year’s figure is also less compared to 2023 ($914) and 2021 ($837). On average, consumers also say they’ll spend slightly less this year on clothing gifts compared to 2024 ($324 versus $337).

While one-third of consumers (33 percent) say they plan to shop the same this year as they have in previous holiday seasons, more than two-thirds (68 percent) indicate they plan to rein in their spending, according to the Monitor™ research. More than one-quarter (26 percent) say they plan to be stricter with their budgets. Another 21 percent say they plan to cut back because “things are too expensive,” and an additional 21 percent plan to reduce spending due to limited funds.

PWC’s outlook mirrors the Lifestyle Monitor™ survey, with its forecast predicting a 5 percent drop in average holiday spending. The firm also predicts an 11 percent drop in the average gift spend. PWC says Gen Z is feeling the pressure more than most, and will spend 23 percent less this holiday. “For retailers, the takeaway is to look beyond price cuts – and to understand how life stage, values and emotion drive spending.”

Fouache said in theory, sales and promotions will be very important this season, as consumers look to make the most of their budgets. He said Akeneo is already seeing predictions for an uptick in spending on key days such as Black Friday and Cyber Monday, as well as in the use of Buy Now, Pay Later (BNPL) payment options. He added that Adobe has estimated between November 1 and December 31, BNPL spending may hit $20.4 billion, a 9-12 percent increase from last year. “Consumers want to continue shopping and gift giving but are taking to alternate ways to spend during economic hardship,” Fouache said.

The National Retail Federation (NRF) expects consumers to spend 1.3 percent less this holiday, for a total of $890, with $628 going toward gifts. The remainder of $263 is expected to go toward seasonal items such as food and décor. The NRF says the top gifts consumers would like to receive are gift cards (50 percent), clothing and accessories (46 percent), books and other media (27 percent), personal care or beauty items (23 percent), and electronics (22 percent).

Mastercard Economics Institute’s (MEI) holiday forecast predicts online sales growth will increase 7.9 percent in the U.S. over last year, compared to a 2.3 percent rise for brick-and-mortar. MEI says inflation will be a larger contributor to sales growth, as opposed to actual sales volume. It adds that the impact of tariffs on consumer prices and spending is not yet clear. “Some retailers betting on sales volume may choose to eat the tariff increases, but there are signs that others will be passing them along.”

Circana’s Classi Zummo says as prices continue to rise, consumers are shifting their holiday spending toward practicality.

“One in five plan to invest more in items people truly need rather than splurging on luxury goods – a clear continuation of the selective purchasing behavior we’ve seen all year, where utility trumps extravagance,” Classi Zummo said. “In apparel, this means a focus on seasonal staples and basics they’ve been holding off on, waiting for the right deal. There’s still room for fashion, but versatility is the new must-have.”

As for how they’ll shop, nearly three-quarters of all consumers (72 percent) say they’ll do at least some shopping in physical stores this year, according to the Monitor™ research. Men (79 percent) are more likely to say they’ll shop in-store than women (67 percent). Additionally, half of those surveyed say they plan to start researching holiday gifts before October. Only a third (33 percent) indicate they will start researching gifts between October and December.

Fouache said today’s consumers have a lot more resources at their disposal to seek out information regarding the quality and origins of the apparel they buy.

“Consumers are combining AI tools, reviews and pre-purchase research to make smarter, more informed decisions,” he told the Lifestyle Monitor™. “Our research found that 89 percent of consumers will look into products before buying, and 77 percent will leave a site if key details are missing. Shoppers have a lot more weighing on their minds and wallets this year, and they aren’t taking any chances.”