For those in retail, you know the New Year is officially here when you find yourself on the floor of the National Retail Federation’s Big Show in New York. And this year, nobody got far into the event without hearing about new iterations of retail AI, the latest in tech, and the economic outlook – which is positive, despite policy uncertainty.

The economic news came after a better-than-expected holiday season. EY’s Gregory Daco, chief economist, said at the NRF press and analyst luncheon that his firm had projected 3.5 percent growth year-over-year for holiday sales. But he said after reviewing post-holiday numbers in terms of credit card spending, figures could surpass that.

Technology enables you to have so much data that you can do a better job that’s more personalized. You know someone’s preferences and purchase history to recommend something relevant.

Ann Ruckstuhl, Senior Vice President & Chief Marketing Officer, Manhattan Associates

The panelists clarified higher prices didn’t drive holiday growth, as volume also increased. Morgan Stanley Wealth Management’s Sarah Wolfe, senior economist and strategist, said “discounting was extraordinarily high and that’s probably what drove a lot of the strength in holiday sales. We finally got decent discounting after a lot of pressure on price in the last couple of years.”

That discounting struck a chord with consumers. Before the holidays, over half of consumers (51 percent) said they planned to be stricter with their budget or cut back on holiday shopping due to limited funds or things being too expensive, according to the 2024 Cotton Incorporated Lifestyle Monitor™ Survey.

But spend they did, and that positive track is likely to continue into 2025, according to the NRF’s Jack Kleinhenz, chief economist, who also spoke at the NRF luncheon.

“The economy remains in pretty good shape,” Kleinhenz said. “The consumer certainly showed it had strength. Its ability and willingness to spend picked up again in the second and third quarter. The labor market seems to be healthy. Unemployment is low. Inflation has improved but it’s been sticky downward. We did see the Federal Reserve reduce interest rates three times this past year, 100 basis points.

“The consumer remains the fulcrum of the economy,” Kleinhenz continued. “And the story line is that this momentum we saw in 2024, in my view, should continue into 2025.”

The show floors at the Javits Center were brimming with companies looking to help retailers keep that drive going, be it through online or in-store hard- and software.

Zebra Technologies showcased multiple products, including a new smartphone-like device called the Panther, whose features include an embedded payment system, an RFID reader that can tell if a shelf is stocked correctly, and it keeps workers connected. The company also exhibited kiosks that operate as self-service payment stations, as well as the latest in connected fitting room solutions, done with partner Crave Retail.

“The consumer puts their clothes on the dressing room hooks, which are also RFID readers,” explained Zebra’s Matthew Guiste, global retail technology strategist, in an interview with the Lifestyle Monitor™ at the NRF Show. “That immediately pulls up a screen in the dressing room showing the item that was brought in. It also tells the store where the item is. If the consumer wants a different size or color, they select it on screen. That triggers a task to an employee through their Zebra device that says, ‘Bring in this size or color.’ Even more than that, the technology is stacking RFID and AI. So, it’s looking at trends in that location. It can tell the customer that people who buy this item also match it with these items, giving suggestions that might complete the outfit. It offers product reviews. And it’s all immediate.”

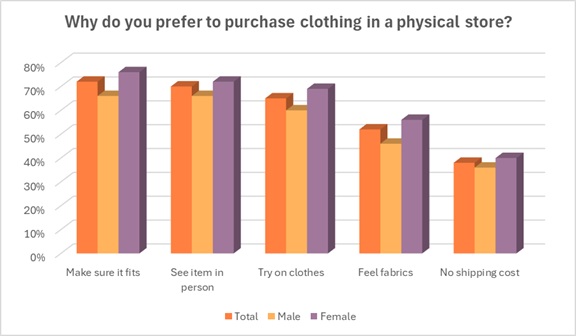

Technologies that can bring the ease and options of online shopping in-store should help engage today’s shopper. As it stands, 73 percent of consumers say they prefer to shop for clothing in stores because they enjoy the overall experience, according to the Lifestyle Monitor™ research. Buying clothes in-store appeals to shoppers because they can make sure an item fits (72 percent), see the garment in person (70 percent), try on the clothes (65 percent), feel the fabric (52 percent), and avoid shipping costs (38 percent).

Another kiosk that can enhance the in-store customer experience and perhaps establish repeat visits came from AWS partner Proto. Its holographic and intelligent retail kiosks combine 3D product merchandising with AI-powered tools, including conversational avatars that can serve as anything from a mall concierge to a retail sales agent. Proto founder David Nussbaum told the Lifestyle Monitor™ at the NRF Show that users spend more than 10 times longer interacting with these holographic kiosks than traditional flat screens.

“Imagine walking into a store, a mall or any retail location and being greeted by a very lifelike holographic avatar that can answer every question about anything you’re searching for in-store or beyond — and it can answer your question in nearly 300 different languages,” Nussbaum said. “It enhances the work of store associates because there’s no way an associate could know every detail about every product in store in every language. It can also help a shopper with requests beyond that store. For example, you can ask for restaurant recommendations near the store, and not only will you get the names of restaurants, but it will give you directions and book you a table. It’s a greeter, a way finder, a directory and a concierge.”

Of course, online shopping is very important to consumers, as well. In fact, 72 percent prefer to browse online and use it for repeat purchasing (66 percent), according to Cotton Council International and Cotton Incorporated’s 2023 Global Lifestyle Monitor™ Survey. Consumers in the U.S. say convenience (65 percent), prices (48 percent), selection/styles (47 percent), and fast shipping (41 percent) are top reasons for purchasing apparel online, according to the 2024 Cotton Council International and Cotton Incorporated Online Shopping Survey.

Manhattan Associates used the NRF Show to present its Unified Commerce technology, which is all about delivering seamless shopping, checkout, fulfillment and a great customer service experience – even if the experience and consumer keep changing.

“As a retailer, you may have thought you had the channel figured out, and it was your online store or maybe your mobile app,” said Manhattan Associates’ Ann Ruckstuhl, senior vice president and chief marketing officer, in an interview with the Lifestyle Monitor™ at the NRF Show.

“Now it’s TikTok Shop, Instagram Shopping, Facebook Marketplace,” Ruckstuhl said. “It doesn’t stop, and you have to be cognizant about how you engage, delight and entertain consumers. Technology enables you to have so much data that you can do a better job that’s more personalized. You know someone’s preferences and purchase history to recommend something relevant. Also, Manhattan Associates knows supply chain, so we know where inventories are across networks, whether it’s in stores, distribution centers, in transit, coming from suppliers. So, retailers can do real-time replenishments and changes based on demand patterns. And they can make changes based on disruption from weather, shipping delays, or something else. Allocation, replenishment and forecast are so much more accurate, so the right things end up in the right place at the right time.”

Manhattan Associates also recently introduced its Postgame Spotlight analytics tool. Amy Tennent, senior director of product management, told the Lifestyle Monitor™ how it could benefit stores.

“Order management for 25 years has been continuously evolving the algorithms and ML (machine learning) around, ‘Which is the best place to pull this order? Should I send from this store? This store has a lot of extra capacity so let’s leverage labor in that store.’ But it’s never really provided insights,” Tennent said. “Postgame Spotlight gives a summary of the data that can be presented to retail allocation and forecasting teams, so they can make meaningful and profitable changes. And it’s all done in minutes. It can be done in near real time.”

Oracle also unveiled the newest version of its Xstore Point of Service (POS) system. The firm says these enhancements “make it easier and more cost effective for retailers to deploy, update and securely build new capabilities on top of the open, extensible Xstore platform.”

In an interview with the Lifestyle Monitor™ at the NRF Show, Oracle’s Paul Woodward, vice president of retail products, explained that the new POS system uses AI to personalize recommendations and facilitate seamless transactions, including order fulfillment through third-party services like Uber. Sustainability is also a major focus, with Oracle tracking the environmental impact of items across their lifecycle, underscoring the importance of the connected journey, consistent experiences and leveraging data to improve both retail operations and customer engagement.

“The unified journey is made up of a lot of little journeys,” Woodward said. “And we capture data and use AI throughout the entire portfolio to bring the journeys to life. This effectively helps the user community, whether they’re looking for better forecasting, prediction, looking to classify data in a better way or searching for data more effectively through chat.”

Oracle is also measuring the sustainability of items, using life cycle assessment (LCA) tools, and measuring how much energy is used throughout the supply chain to get a particular product to market.

“We’ve tapped into hundreds of data sources,” Woodward said. “The sources include the farmers themselves, logistics, the import/export capabilities. And by tracking all that, you can piece the journey together and use an AI language model to learn the norm. There are also several big organizations that created these life cycle assessments, so we embed the LCA results into our process, providing comprehensive environmental impact analysis. It gives the consumer choice, and it gives the retailer that added scope for analysis.”