Four years ago, fashion week shows were held online, retail stores became fulfillment centers, adults and school children stayed in pajamas and loungewear all day as many began remote work and schooling and there were more wild animals on city streets than shoppers. Things were decidedly not normal, thanks to the COVID-19 pandemic.

The bottom on pricing should be pretty close in terms of fiber prices…And as we move on from there, we can get some profitability brought back into the market.

Jon Devine, Senior Economist, Cotton Incorporated

Of course, all of this affected the fashion industry from the brands and retailers to the textile manufacturers, the mills and farmers that produce natural fibers like cotton. Subsequent sourcing interruptions, inflation, and concerns about recession were some of the pandemic’s lasting effects. But now, experts say it seems we’re “coming back to normal.”

And that’s good news as the industry recently acknowledged the third official United Nations World Cotton Day on October 7. The day is meant to acknowledge that “cotton is more than just a commodity. This natural fabric is a life-changing product worldwide that sustains 32 million growers (almost half of them women) and benefits over 100 million families across 80 countries in 5 continents.”

In his last Monthly Economic Letter, Cotton Incorporated’s Jon Devine, senior economist in the corporate strategy and program metrics division, states that after several months of decline, cotton prices stabilized in August.

“Things have been tougher for U.S. growers because prices are down,” Devine told the Lifestyle Monitor™ in an interview. “But for manufacturers, they should gradually see things come back to normal. The orders were overbooked up to the first half of 2022, but it’s been really quiet since then because inflation and higher interest rates raised concerns about recession. As we move beyond those fears, we should see a return to more predictable business conditions. This should be a relief because the volume on orders has been switching back and forth between zero and 10 in recent years. If orders can settle back at a comfortable 6 or 7 and be less herky-jerky. It will bring more clarity and more ability to plan.”

And retailers should be planning for a solid fourth quarter, according to the National Retail Federation’s Jack Kleinhenz, chief economist.

“The momentum of the economy during the third quarter looks decent even though the labor market is showing some weakness,” Kleinhenz told the Monitor™ in an interview. “Consumers have remained resilient and have been driving the economy. Spending for the first 8 months of the year is very much in line with NRF’s 2024 forecast of retail sales growth between 2.5 percent and 3.5 percent, which is great, although a bit of a slower pace than last year. The holiday shopping season is just around the corner, and we believe consumers will remain engaged for the holiday season.”

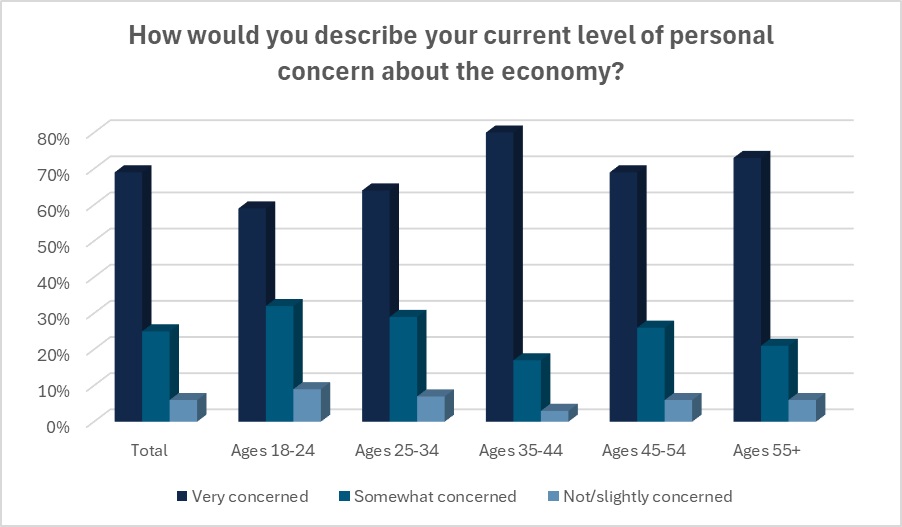

Consumers remain challenged, though. For the last two years, the majority (68 percent) have said they are “very concerned” about the U.S. economy, according to Cotton Incorporated’s Inflation and Supply Chain Survey (U.S. edition, Wave 8). Their top concerns focused on the prices of everyday goods like groceries and household items (58 percent), wages/salary keeping up with the cost of living (43 percent), and the cost of gas (32 percent).

These concerns, however, are not preventing them from spending. Shoppers were out in force during the recent Back-to-School shopping period. Consumers planned to spend an average of $472 on back-to-school clothes this year, up significantly from $378 in 2023, but down from $520 in 2022, according to Cotton Incorporated’s 2024 Lifestyle Monitor™ Survey. The higher spending in 2022 reflects Devine’s assessment that consumers were making up for not spending during the pandemic when work-from-home and distance learning were widespread.

But for consumers to have planned to spend so much more this year than last, especially given their economic concerns, signals a bit of a difference between what they cite as a concern versus their actual spending.

“Yes, there is a disconnect between consumer attitudes and consumer spending,” Kleinhenz says. “Consumer confidence survey data shows figures typically associated with a slowdown or in recessionary territory for some time. [But] American consumers like to spend and have had the capacity to spend despite higher prices.”

Overall, most U.S. shoppers agree that clothes shopping is a fun, social activity (64 percent), according to the Inflation and Supply Chain Survey. And most say they “feel hopeful for the future” (65 percent).

Even though consumers have been spending, retailers have been managing inventories and have been careful with orders due to concerns about an impending looming recession. Despite sluggish downstream demand, cotton prices briefly reached $1 per pound in the early part of 2024. This surge was driven by worries regarding the availability of exportable supply.

More recently, the market has flipped its outlook. In the 2024/25 crop year, reflective of cotton being harvested now, a record volume of exportable supply is set to hit the market. With demand sluggish and supply available, prices retreated and have been trading at levels close to $0.70. For the supply chain, a silver lining of these lower prices, is that a bottom may have been reached for the price cotton after several years of higher values that followed the pandemic.

“Once you get the bottom in, that may help with profitability throughout the supply chain,” Devine says. “Somewhat counterintuitively, it is not a good thing for spinning mills when fiber prices drop. Yarn and downstream prices respond immediately to price changes. Meanwhile, the raw materials purchased at higher prices can take a few months to arrive. With the series of price decreases since their 2022 peak, manufacturers have been repeatedly getting their knees cut out from underneath them as cotton prices have moved lower. Their financial situation was made worse by cautious order placement from retailers and brands due to their fears of recession. So, if we can finally get to a situation where the bottom is in for fiber prices, and then we come up off the bottom, that can help spinning mills in terms of their ability to stop losing money. In addition, if recent and upcoming decreases in interest rates can lift fears of a possible recession, that can help get demand going, which could help participants throughout the supply chain, ranging from the growers to manufacturers.”

The Federal Reserve lowered interest rates by 0.50 percentage points, the first reduction in four years. Additionally, J.P. Morgan strategists believe there will be two more rate cuts in 2024, with cuts continuing into 2025. Devine says that when the Fed started increasing interest rates in March of 2022, there was a pullback in demand because higher interest rates are often followed by recessions. With the rate drop, confidence regarding the macroeconomic outlook may improve and orders may start to increase.

In 2025, growers probably won’t plant as many acres of cotton here in the U.S. Lower prices and higher input costs present a tough situation for cotton producers. Devine says demand may eventually edge higher, which could help to deplete excess cotton stock, and potentially set growers and manufacturers up for a better price situation moving forward.

The market for cotton may also change with recent actions announced by the White House, where it’s looking to enforce laws and address “significant increased abuse of the de minimis exemption, in particular China-founded ecommerce platforms, and strengthening efforts to target and block shipments that violate U.S. laws.” Currently, import shipments are eligible for de minimis exemption if the package is valued at $800 or less. The shipments enter the U.S. with less information than other imports and are not subject to duties or taxes.

Direct-to-consumer retailers Temu and Shein have benefited greatly from the de minimis loophole. Both China-based companies rely heavily on inexpensive synthetic/manmade materials. Changes to the de minimis rule could potentially stem the flow of low-price synthetic goods, and encourage consumers to look for better quality, more durable apparel that benefits U.S. brands.

As far as cotton production, the biggest year over year increase is expected to come from the U.S., which has seen an increase of about 2.5 million more bales than last year. But the increase only seems so big because in 2023, the U.S. market saw its smallest crop since the 1980s.

Overall, the U.S. market has seen a decrease in production that stems from issues with weather.

“We get one shot at planting, then the planting is already done and the forecast moves lower,” Devine explains. “Things got hot and dry in Texas and that affects the crop outlook that’s the big piece. Then smaller pieces are things like storms that have been coming through that could have some impact. But the big factor is always West Texas, which is an important growing region. They haven’t had enough water in recent years and it’s the same story this year even though they got off to a better start. They planted more acres. And we were hoping to have a big crop. But it’s difficult land leading to lower yields. So, we’re sort of dead center to where we’ve been for the past five years, which have all been affected by drought out there in Texas.”

The U.S. cotton prices also contracted due to strong Brazilian production, which reached 14.6 million bales in the most recent crop year, a record for the country. Devine explains that as a tropical country, Brazil’s agricultural environment is year-round. Over the past 10 years or so, farmers have planted two crops on the same land within the same year. For instance, they can plant soybeans, harvest them and then plant corn or cotton right after that, increasing production in their acreage without increasing their acreage. Everywhere else in the world, growers can usually only plant one crop. Since Brazil has so much to export, its prices dropped into the spring, which drove down prices on U.S. cotton.

Globally, the U.S. Department of Agriculture expects 2024/25 will see decreases in global production (-1.2 million bales to 116.4 million) and mill-use (-463,0000 to 115.7 million).

In Pakistan, cotton production has seen a decrease of -300,000 bales to 5.7 million, but its spot prices increased from $0.76 to $0.81 cents per pound. Devine says several factors have come into play that have affected Pakistan’s production.

“Pakistan had issues with their cotton seeds,” Devine explains. Seeds can have different traits, including the ability to protect the seed from pests. “They haven’t had the best controls, so they have lost some of that protection over time. They need new seeds to come in. They’ve also had issues with flooding. And the financial situation as a whole isn’t great in Pakistan. Also, the weather has been really hot to the point that at times this year, temperatures were about 120 degrees. So, they have had challenges on several fronts.”

India’s spot prices increased from $0.86 to $0.90 per pound. India’s production decreased by -500,000 bales to 24 million. The country also had issues with weather over the last few months and their crop numbers are getting smaller. However, India implemented minimum support price (MSP) guarantees to growers over the past several years. When prices were higher and above the guaranteed price, it wasn’t a problem. But now that prices are lower, the Indian government will likely need to step in, as the MSPs are enforced by the government. This also means the government would take possession of the cotton and withhold it from the market. But unlike in China, where cotton can be stored for years, storage in India is usually for just a period of months. The cotton may come back on the market only to be sold at a loss.

China remains the world’s largest cotton producer. Its production increased +300,000 bales to 27.8 million. China also has a reserve stock that was brought in last year, making their market well supplied moving into the 2025 season. This means it’s decreasing its imports by -500,000 bales to 9.5 million. That’s a big difference from last year when the country replenished its stock with imports from countries that included the U.S., Brazil, Australia, and West Africa. Another concern is that while Chinese consumers have represented a tremendous market for both apparel and textiles, the outlook for growth is sluggish right now.

“As they came out of COVID, the collapse in the housing market is a huge issue for them,” Devine says. “We’ve seen housing prices there decrease anywhere from 15 percent to maybe 20 percent, so that’s a big impact on the household finance situation in China. And if household finances aren’t looking good, they’re going to be less likely to spend. We are seeing some stimulus come out in China, but nothing really in comparison to what was released in the U.S. and Western markets with COVID. We’re probably not going to see the strength of consumer demand that we’ve seen in the past couple of decades.”

But in the U.S., again the overall economic outlook is favorable, and the outlook for cotton pricing is seeming to head in a positive direction.

“The bottom on pricing should be pretty close in terms of fiber prices,” Devine says. “And as we move on from there, we can get some profitability brought back into the market.”