Sizing Up Consumer Preferences – Supply Chain Insights

August 28, 2024

SIZING UP CONSUMER

PREFERENCES

COTTON INCORPORATED’S

SUPPLY CHAIN INSIGHTS

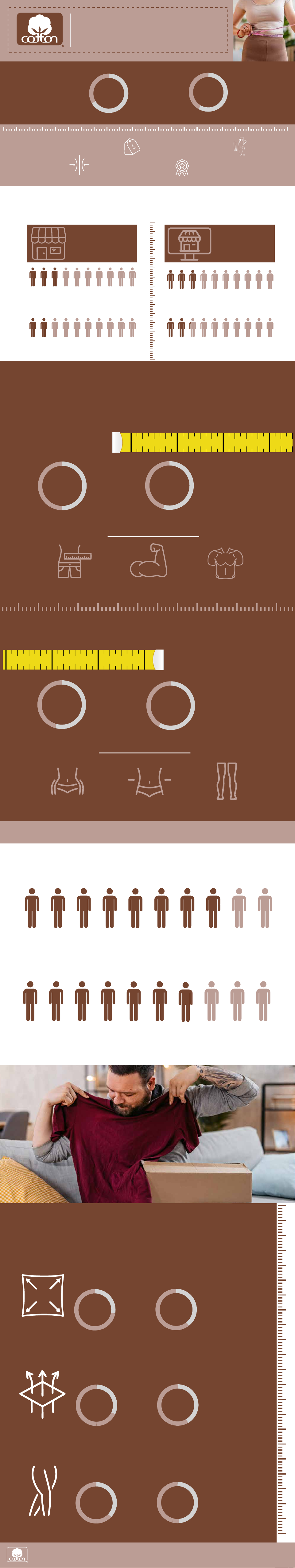

Plus Size Apparel

Forecasts

Higher Growth

$1.43

trillion

All

apparel

1

$237

billion

Plus size

apparel

2

+30% +40%

2023 market value and projected

5-year growth, 2023-2028

Sizing is a Priority for All

Sizing Impacts Shopping Experience

Size/fit of clothes

Quality of clothes

Prices

Style/selection

81%

76%

76%

73%

% important

when deciding

where to shop

for clothes

27% plus size

20% standard size

In-person

30% plus size

23% standard size

Online

% consumers who dislike clothes shopping

Difficulty with Fit is Common

% consumers report at least one area of poor fit

44%

45% shirts

plus

size

standard

size

50%

Areas of poor fit

Torso length Arms Bust/chest

40%

41% pants

plus

size

standard

size

44%

Hips Waist Length

Areas of poor fit

Stronger Preference for Cotton

% prefer clothing made of cotton or cotton blends

80% plus size

69% standard size

Greater Interest in Performance

% likely to look for clothing with…

60%

plus

size

standard

size

69%

Breathability

51%

plus

size

standard

size

62%

Chafe resistance

63%

plus

size

standard

size

72%

STRETCH

Plus Size Clothing Preferences:

For More Information Contact: Corporate Strategy & Insights at [email protected]

Cotton Incorporated’s 2024 Sizing Survey, a survey of N=973 U.S. consumers on March 20-21, 2024

Sources:

1

Euromonitor International,

2

“Plus Size Clothing Market” Future Market Insights 2024

AMERICA’S COTTON PRODUCERS AND IMPORTERS. Service Marks/Trademarks of Cotton Incorporated. ©2024 Cotton Incorporated.