Earlier this summer, Limited Too held a rooftop party in New York to kick off the return of the iconic tween brand before the start of the new school season. Macy’s relaunched its Epic Threads children’s brand with more than 200 school-ready items. And PacSun recently introduced its “Better in Baggy” campaign featuring the brand’s latest denim styles. Yes, though summer’s waves may beckon, for apparel retailers and brands, it’s time to pack up the sunblock and focus on Back-to-School (BTS), which is projected to see increased and near-record spending this season.

This season, we’re introducing a larger collection of novelty embellished denim, due to overwhelming demand for those styles from our community. These pieces are designed to empower our customers to express themselves through style, especially as they head back to school.

Addie Rintel, Vice President of Women’s Merchandising and Design, PacSun

“The Back-to-School and college season is an important time for retailers and consumers,” says the National Retail Federation’s (NRF) Katherine Cullen, vice president of industry and consumer insights. “Families and students are eager to get a jumpstart on their shopping for the start of the school year. Retailers have anticipated this early demand and are well-positioned to offer a variety of products at competitive prices.”

The NRF expects total Back-to-School spending to reach $38.8 billion, the second-highest figure on record after last year’s high of $41.5 billion.

JLL Retail Research conducted a survey that finds parents intend to start BTS shopping sooner, spend more than last year and utilize brick and mortar retailers.

“Despite concerns about inflation, our survey demonstrates that parents are prioritizing Back-to-School essentials and will continue to play a crucial part in driving consumer spending and foot traffic,” says JLL’s Keisha Virtue, senior analyst of retail research.

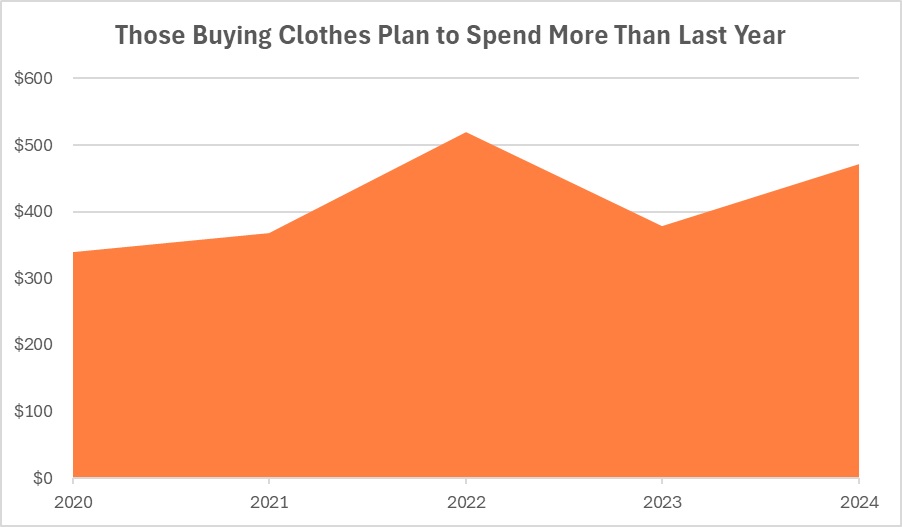

Consumers plan to spend an average of $472 on BTS clothes for the upcoming school season, according to Cotton Incorporated’s 2024 Lifestyle Monitor™ Survey. This is up from $378 in 2023 and down from $520 in 2022.

Corresponding with JLL’s assessment, the Cotton Incorporated 2024 Back-to-School Supplemental Survey finds parents will do most of their BTS shopping (95 percent) in-store, with 70 percent taking place online. Among students ages 13+, 89 percent plan to shop for new clothes in a physical store, versus 71 percent online.

Even though shoppers plan to spend more than they did last year, parents will definitely be looking for deals, as the majority (84 percent) say they plan to shop mass merchants such as Target and Walmart for school clothing, according to the BTS Supplemental Survey.

“With the hefty rise in parents shopping in physical stores and the availability of multiple retail options, parents are taking advantage of sales, deals and coupons while also exploring different store options to find the best value for their Back-to-School needs,” says JLL’s Naveen Jaggi, president of retail advisory services.

And for those purchasing in-store, besides the mass merchants, parents are also planning to shop for school clothes at off-price stores (62 percent), apparel specialty shops (55 percent), and department/chain stores (50 percent), according to the BTS Supplemental Survey. Among students shopping in-store, 60 percent plan to shop at mass merchants, and 52 percent plan to visit department/chain stores, followed by 51 percent who expect to shop at off-price stores and specialty shops (47 percent).

Of note, nearly twice as many students (40 percent) as parents (22 percent) plan to shop in-person at fast fashion retailers like Zara or H&M, according to the BTS Supplemental Survey. Also, online fast fashion retailer Shein is significantly more popular with students (53 percent) than parents (40 percent). Overall, the top online shopping sites are Amazon (86 percent among parents, 79 percent among students) and the online platforms of brick and mortar stores (70 percent among both parents and students).

While both parents and students name comfort as their top purchase driver, parents next prioritize quality and durability, followed by trendy styles, according to the BTS Supplemental Survey. Students, meanwhile, followed their preference for comfort with trendy styles.

Those trendy styles will likely include preppy and nostalgic pieces, according to Trendalytics. For instance, the girls’ market will see bubble hem skirts, drop-waist dresses, and barrel leg jeans. Leopard prints will be popular on everything from denim to dresses to outerwear. And in keeping with classic styles, stripes and gingham will be consumer favorites. Top colors for girls are expected to be magenta, cherry red, buttercream yellow, and baby blue.

In the boys’ category, Trendalytics says relaxed and classic styles will rule the season. Think relaxed fit jeans, graphic tees, and dark wash denim jackets. The agency says boys’ knitwear will continue to grow in the market from sweaters to sweater vests. And chore coats, popular in men’s wear, will grow in popularity with the younger male set. Trendalytics sees camo, stripes, and argyle making print statements while classic colors like navy blue, red, Kelly green, and mustard yellow are expected to be consumer favorites.

Stores and brands will find T-shirts remaining popular, as well, as they’re favored by nearly half of all students ages 3-15 (48 percent), according to the BTS Supplemental Survey. The other half of students prefer to wear hoodies/sweatshirts/sweaters (18 percent), casual or dress shirts (14 percent), active tops (11 percent), or dresses (11 percent).

As in past school years, retailers should expect athleisure items like sweatpants, joggers, and leggings to remain popular (33 percent) along with denim jeans (28 percent) according to the BTS Supplemental Survey. And stores should note that denim jeans increase in popularity with age, seeing as they’re popular with just 20 percent of preschoolers and kindergarteners – or those ages 3-to-5 – but favored by more than one-third of teens (35 percent).

That’s something PacSun is prepared for with its “Better in Baggy” campaign, which is documented by members of the brand’s community and captures a stylish young group of friends journeying from the streets of NYC to the peaceful landscapes of upstate New York, all while highlighting PacSun’s newest baggy denim fits.

“Our fall campaign is a celebration of self-expression and individuality,” says PacSun’s Addie Rintel, vice president of women’s merchandising and design. “This season, we’re introducing a larger collection of novelty embellished denim, due to overwhelming demand for those styles from our community. These pieces are designed to empower our customers to express themselves through style, especially as they head back to school.”

Learn more about consumers & the 2024 back-to-school season.