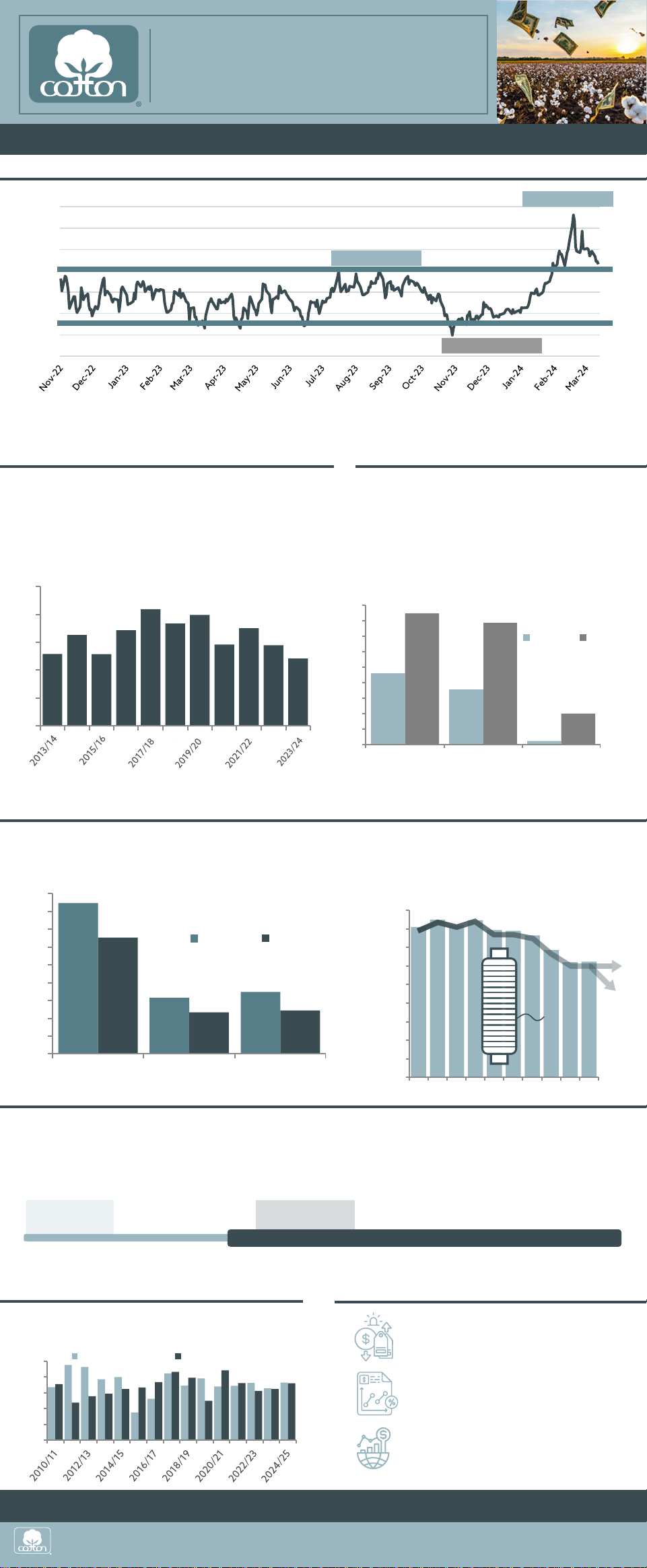

Cotton Prices: Will They Hold Up?

April 1, 2024

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

70

75

80

85

90

95

100

105

1

NY/ICE Nearby futures in cents/lb

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

2022/23

Supply Concerns

COTTON PRICES:

WILL THEY HOLD UP?

COTTON INCORPORATED’S

SUPPLY CHAIN INSIGHTS

Cotton prices were range-bound for more than a year. That range held against alternating challenges based on

concerns about lower supply and sluggish demand before breaking higher.

Supply Concerns: Small U.S. Crop

Aggressive buying from China locked up exportable

supply from U.S., Brazil, and Australia.

Purchases from China are associated with the Chinese

government’s reserve system. The reserve system sold

cotton from July to November and has been buying

imports to replenish that inventory.

Chinese Buying

Cotton Prices

U.S. production is concentrated in West Texas. This area is dry and

most cotton in the region is not irrigated.

Because cotton is drought-tolerant, it is the only major agricultural

option in West Texas. However, it needs some moisture to grow,

and the region has had several years of drought.

million bales

U.S. Export

Commitments to China

Brazilian Exports

to China

Australian Exports

to China

12.9

16.3

12.9

17.2

20.9

18.4

19.9

14.6

17.5

14.5

12.1

0

5

10

15

20

25

million bales

U.S. Cotton Production

+84% +121% +781%

Export Demand from China

Crop-Year-to-Date

Learn the reasons why cotton prices surged in recent weeks and explore the outlook for the market in

coming months.

2023/24

Supply Concerns

Demand Concerns

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

2022/23

2023/24

Looking forward

100

102

104

106

108

110

112

114

116

118

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Falling USDA Mill-Use Estimates

The USDA releases the first official estimates for a

crop year in May. As the crop year has progressed,

forecasts for global cotton mill-use have fallen due

to slow downstream orders. It remains to be see if

downward trend has reached a bottom.

Production & Consumption

Economic & Price Outlook

Demand Concerns: Slow Buying Outside China

80

90

1

00

110

120

130

World Production World Mill-Use

Export Demand Outside of China

Crop-Year-to-Date

million bales

Purchases outside of China are driven more by mill-demand, and

the steep year-over-year decreases indicate global mill purchasing

has been weak this crop year.

In the upcoming 2024/25 crop year, the USDA expects

production and mill-use to remain balanced but at slightly higher

levels than the current crop year.

-23%

-26%

-30%

INFO: MARKETINFORMATION@COTTONINC.COM LIFESTYLEMONITOR.COTTONINC.COM

Sources: Federal Reserve

1

, USDA

1

, Refinitiv

1

, USDA WAOB

2

©2024 Cotton Incorporated.

U.S. Export

Commitments outside China

Brazilian Exports

outside China

Australian Exports

outside China

Cotton supply and demand is framed in terms of crop years that reflect the seasonality of the northern hemisphere harvest and

run from August to July.

2024/25 Crop Year (begins August 2024)

Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul

Period of most

intense harvesting

Planting decisions

made for an

upcoming crop year

Acreage decisions are made in the winter and early spring. The recent surge in cotton prices can be expected to help bring in

more acres for the upcoming 2024/25 crop year. Any additional production next crop year could calm concerns about limited

exportable supply.

Interest rates in the U.S. and other markets

are forecast to decrease in 2024, but are

expected to remain well-above the average

over the past 15 years.

Global economic growth is expected to pick

up, but hold at slower rates than lower than

those experienced ahead of the pandemic.

Both supply and demand are expected to move higher in 2024/25. Prices for delivery after the 2024/25

harvest are about 10% lower than prices for more immediate shipment.

Inflation rates have moved lower, but price

pressures remain higher than they were

before COVID.