It’s that time of year again, when all the holiday cookies, candy and charcuterie boards combined with perhaps a (severely) reduced exercise regimen has many Americans busting out New Year’s resolutions as much as they’re busting out of their jeans. Silver lining: It’s good for the activewear industry.

The pledge to exercise more (50 percent) is a top resolution for 2024, preceded only by “saving more money” (59 percent), according to a survey by Statista Consumer Insights. Also in the top five: a resolve to lose weight (35 percent). It might come as no surprise that dropping pounds and improving fitness levels are perennial resolutions among Americans.

Colors are designed to pop on-screen. Apparel design for this market must be hyper breathable as many experiences take place in the home, which is not generally as well-ventilated as, say, the gym.

LTP Group

Of course, new activewear goes hand-in-hand with intentions toward a new fitness routine. And these goal-oriented purchases have helped the global activewear market reach $319 billion, according to Statista. The firm predicts that figure will increase 40 percent by 2027. Further, Statista says the women’s activewear market is one of the fastest growing segments in the active arena and forecasts it will be worth $242.5 billion by 2027. Back in 2022, the U.S. activewear market alone was worth $73.3 billion. That is expected to increase to $93 billion by 2026. Statista includes footwear, sportswear, swim, and yoga in its activewear category.

The year sees new concepts coming to the active community — some more high tech than others. Take the Soaak mobile app, which claims its sound frequency sends a signal to the brain that improves workout performance, and increases oxygenation, aerobic capacity and muscle mass. True, this app has nothing to do with apparel, but if it got people to work out more, perhaps they would need more workout gear. In another high-tech leap, LTP Group, the Danish-owned garment maker, says the activewear industry should be prepared to design clothes specifically for AR (augmented reality) and VR (virtual reality) workouts.

“Opt for arcade-inspired aesthetics with a softly retro vibe,” LTP advises. “Colors are designed to pop on-screen. Apparel design for this market must be hyper breathable as many experiences take place in the home, which is not generally as well-ventilated as, say, the gym. Inspiration is drawn from the Teslasuit featuring full-body haptics that enable the wearer to ‘feel’ the digital world with real sensations that mimic those taking place on-screen. Directional brands will also offer product twins for in-game and IRL (in real life) use.”

Sure, that may sound futuristic but activewear has steadily been about performance technology. And today’s consumers are here for it. As it stands, nearly 7 in 10 consumers (67 percent) say they are at least somewhat likely to look for performance features in activewear items like tops, pants, and shorts, according to the 2023 Cotton Incorporated Lifestyle Monitor™Survey. Male consumers (74 percent) are significantly more likely to look for performance features in active tops, pants, and shorts than their female counterparts (63 percent).

When purchasing activewear, consumers are looking for performance features like easy care (84 percent), shrink resistance (80 percent), odor resistance (80 percent), moisture management (79 percent), thermal cooling (77 percent), chafe resistance (77 percent), stain resistance (76 percent), and abrasion resistance (76 percent), according to the Cotton Council International and Cotton Incorporated’s 2022 Global Activewear Study.

Consumers are also looking for their activewear to be sweat-hiding (74 percent), anti-microbial (73 percent), fade resistant (71 percent), water repellant (69 percent), wrinkle resistant (68 percent), UV protecting (67 percent), thermal warming (64 percent) and insect resistant (59 percent), according to the 2022 Global Activewear Study.

But some consumers are also indicating they are interested in more high-tech features, such as biometric apparel that can offer biological data (53 percent), apparel that can control devices (51 percent), and activewear that can charge devices (49 percent), according to the 2022 Global Activewear Study.

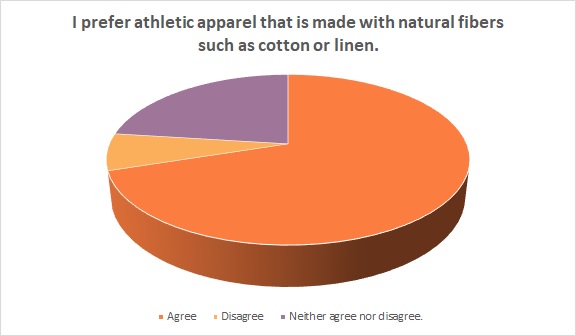

Of note, regardless of the performance features consumers are seeking, the majority (70 percent) say they prefer athletic apparel that is made with natural fibers such as cotton, according to the 2022 Global Activewear Study.

Perhaps that’s why more brands from luxury to fast fashion are showing cotton in their active category. For instance, Able Made used donated cotton fabric from Burberry to create items for its aspirational Made2.01 collection. At the same time, fast fashion’s Forever 21 has a number of cotton-rich active pieces on its website, from biker shorts to crop tops to a full-body jumpsuit that features a moisture-wicking fabric. Additionally, a curated selection of cotton activewear pieces for men, women and kids is featured in the Cotton Shop on the Fabric of Our Lives website, available to purchase through the designer or retail sites.

Makers looking to add performance cotton to their activewear category should know Cotton Incorporated has a number of technology solutions that can be used for moisture management, repellency and more. For instance, TransDRY® technology combines the comfort of cotton with moisture wicking performance that rivals any competitive fiber in the market. STORM COTTOM™ technologyoffers a water-repellent finish for protection from rain and snow while maintaining the softness and comfort of cotton. TOUGH COTTON™ technology brings increased durability and superior abrasion and wrinkle resistance throughout the life of the garment.

So, whether it’s to improve fitness, reduce stress or burn off some of the many, many calories that were consumed between Halloween and New Year’s Day, brands are increasingly giving consumers options when it comes to the type of performance activewear they prefer.