Real talk: In December of 2019, nobody could have predicted what was to happen in 2020. But 2020 was a total outlier. Normally, people can rely on predictions. And right now, it’s that time of year when industry experts weigh in on what will be trending — and what those trends will mean for both retailers and consumers in 2023. From the impact of inflation to sustainability concerns to capturing fleeting consumer attention, brands, and retailers have their jobs cut out for them.

Americans have ultimately fashioned themselves a new dream based on the realities of today, one with more modest ambitions, and brands must cater to it.”

Moana Tellbuescher

Senior Trends Analyst, GWI

For starters, Americans are lowering their ambitions and trading an appetite for success with more modest goals, writes GWI’s Moana Tellbuescher, senior trends analyst at the audience research company.

“While there will still be some post-pandemic splashing out, 2023 is likely to see similar changes in spending habits and in American culture as we observed during the Great Recession,” Tellbuescher states in the report, “The New American Dream – How Consumers are Craving the Simple Life in 2023.” “Americans have ultimately fashioned themselves a new dream based on the realities of today, one with more modest ambitions, and brands must cater to it.”

Infor’s Vincent Barnes, director of retail strategy at the global cloud software firm, agrees that the prospect of a recession will affect consumer shopping.

“Consumer behavior is already starting to change due to price increases across all customer segment groups,” Barnes says in an interview with Lifestyle Monitor™. “So industry leaders should assume all households will be extra careful in their spending, and opting for cheaper and longer-lasting products in 2023. To address this growing concern, businesses should ensure they are leveraging integrated planning strategies with product lifecycle management (PLM) approaches to build more valuable and durable products.”

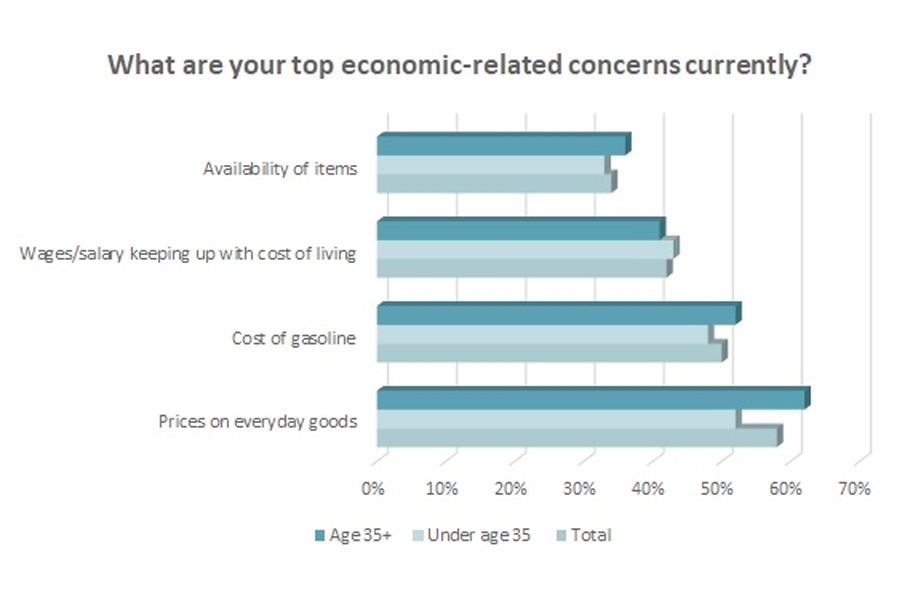

As it stands, 68 percent of U.S. consumers are very concerned about the economy according to Cotton Incorporated’s 2022 Inflation and Supply Chain Survey (Wave 3, October 2022). Consumers say their top economic concerns are the prices of everyday goods such as groceries and household items (58 percent), the cost of gasoline (50 percent), and wages/salary keeping up with the cost of living (42 percent).

Margo Kahnrose, chief marketing officer of Skai, an omnichannel marketing platform, says in recessionary times, consumers do more research before making a purchase.

Data from the 2022 Inflation and Supply Chain Survey bear this out, as 34 percent of consumers say they are spending more time researching what they plan to buy. Beyond spending, 56 percent say they’re buying less of the things they want; 44 percent are taking better advantage of sales, discounts, and promotions. Another 44 percent say they are buying generic/store brand items, while 43 percent are shopping at lower-priced retailers. Additionally, 38 percent of shoppers are buying less of the things they need, while 29 percent are putting off purchases until things improve.

Kahnrose says in this type of climate, it takes more advertising engagement and potentially a longer journey to get consumers to purchase.

“Performance channels like paid search, social media and retail media are moving the needle on consumer engagement and advertising-sourced revenue for brands, especially during the high-intent holiday shopping season,” Kahnrose says in an interview with Lifestyle Monitor™. “For example, Skai’s Black Friday data showed that retail media ads generated 192 percent higher revenue on Black Friday when compared to the November daily average.”

Inflation-related change isn’t the only driver for 2023. Barnes says sustainability will be a strong factor, as well.

“We are likely to see fashion brands sourcing more sustainable materials and providing true transparency into their extended supply chain,” Barnes says. “Additionally, the materials, processes and production techniques of new collections will be better measured and designed to have lower environmental impact scores. Fashion brands will also begin considering ways to extend the lifecycle and offer services around existing products in 2023. One way could be to offer repair, rental, resell and recycling services rather than taking more products to market. Integrating with resell platforms can help leftover stock get sold rather than wasted, and extended services for products after sale can help extend the lifetime of an item.”

This reflects the sentiment of the majority of consumers (58 percent), who say the past few years have changed the way they will shop for clothes in the future, according to the Cotton Incorporated Lifestyle Monitor™ Survey. More than four in ten consumers (41 percent) say they will be more purposeful with the clothes they buy. Another 30 percent say they will buy higher quality or longer-lasting clothes. Nearly half of all consumers (48 percent) say they will pay more for better quality clothes, too. And most (75 percent) say better quality garments are made from all natural fibers such as cotton.

Barnes’ prediction regarding second-hand shopping is already coming into play. Half of all consumers (50 percent) have purchased clothes from a thrift shop like Goodwill or Salvation Army, or a consignment store like Plato’s Closet. Another 15 percent have bought from online second-hand retailers like thredUP and Poshmark, while 13 percent have bought clothes from online platforms like Facebook Marketplace or eBay. Additionally, 46 percent of consumers say they expect to purchase more used/second-hand clothes in the future, a figure that increases to 53 percent among Millennials.

Barnes also predicts technology and automation will increase in 2023, especially for smaller brands. He says recent years have shown a shift toward creating enriching brand experiences for customers to share on social media. He points to Jimmy Choo’s hot pink café in Harrod’s. But smaller brands often don’t have the ability to explore and provide such experiences.

“In 2023 and the years to come, these smaller teams will likely adopt more technology to automate some processes and free up talent to create these brand experiences and focus on more specialized roles,” Barnes says. “In doing so, (smaller) brands will be able to focus more on providing memorable and unique customers to ultimately increase exposure and stand out amongst the competition.”

Skai’s Kahnrose says 2023 will continue to challenge retailers both in-store and online when it comes to connecting with consumers through those all-important experiences.

“Sophisticated brands and retailers will be looking to create continuous communication with consumers across channels and devices,” Kahnrose states, “from online demand creation and capture to in-store promotions and activations, in order to engage shoppers and create convenient experiences.”