Looking back on 2020, did it really only last one year? It started with unsettling murmurs of a strange new virus. That was followed by the first impeachment of President Trump, then COVID-19 shutdowns and stay-at-home orders, Black Lives Matter marches, the contentious 2020 presidential campaign, major wildfires in the West, record-setting hurricanes, tropical storms and tornados, the wait for the presidential election returns, and finally the tumultuous post-election period. It’s no wonder interest in health and wellness grew significantly last year. And that has an impact on the types of clothes consumers will be looking to buy in 2021.[quote]

The wellness industry was valued at $4.5 trillion in 2018, according to the Global Wellness Institute, a nonprofit dedicated to worldwide wellness education. Since the industry was growing annually by 6.4 percent, it is estimated it surpassed the $5 trillion threshold last year, according to PolicyAdvice, an insurance and healthcare platform. Considering a lot of the issues that brought about by the pandemic have continued into 2021, the wellness trend won’t likely stop anytime soon.

The National Institutes of Health (NIH) offers “Wellness Toolkits” that offer users guidance for improving areas of their well-being, whether it’s physical, social or mental health. This translates into activities that include working out, hiking, engaging in mindful relaxation or meditation, and (healthy) socializing. Any increase in the adoption of all those practices stands to benefit the activewear, loungewear, and athleisure markets.

“Let’s be real, 2020 was a crappy year for retail. Unless, you were in activewear,” writes Edited’s Kayla Marci, market analyst. “The already successful category appeared to be pandemic-proof, accounting for a record high 40 percent of all online sales last year.”

When the pandemic began, consumers very quickly changed up their routines. Nearly three-quarters (71 percent) began watching more TV, movies, and videos than before the pandemic, 52 percent were eating more “comfort” and snack foods, and 26 percent were exercising more while 34 percent were working out less, according to Cotton Incorporated March 2020 Coronavirus Consumer Response Survey, Wave 1. By the end of the year, more were eating “comfort” food and snacks (57 percent), but the number of people who were watching more TV than before the pandemic decreased to 67 percent, and those who were exercising more increased to 33 percent, according to the Cotton Incorporated November 2020 Coronavirus Consumer Response Survey, Wave 4.

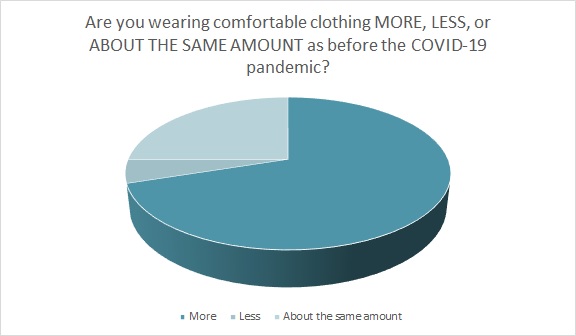

Whether it was to workout, relax or simply work from home, the majority of consumers (63 percent) began wearing more comfortable clothes right away, according to Cotton’s March Coronavirus Response Survey, Wave 1. Not only did that trend continue, but the figure significantly increased to 70 percent in Cotton Incorporated’s November Coronavirus Response Survey, Wave 4.

It’s not just the style of clothes that makes these outfits comfortable, it’s the fabric. Compared to manmade fiber clothing, more than 7 in 10 consumers say cotton clothing is their favorite to wear (85 percent), most comfortable (84 percent), and softest (84 percent), according to the 2020 Cotton Incorporated Lifestyle Monitor™ Survey.

By the end of this March, 30 percent of consumers plan to buy new activewear, according to the Cotton Incorporated November Coronavirus Response Survey, Wave 4. Another 27 percent plan to purchase athleisure apparel and 29 percent plan to buy loungewear, such as sweatpants or joggers.

The Global Wellness Institute says mindful movement is growing in popularity in the U.S., with yoga leading over Pilates, barre, and stretch routines. The mainstreaming of yoga is having an effect on the direction of today’s workouts. Instead of pounding, jumping and fat burning, yoga participants are moving toward more deliberate exercises that focus on balance, flexibility, alignment, and breath.

Edited’s Marci says yoga apparel sales surged during the pandemic. The category had already been a sportswear staple, but interest in the activity for those working out at home helped boost sales 36 percent in 2020. Further, she says, there is an opportunity in the men’s yoga arena, as items for guys increased 45 percent.

Of course, wellness isn’t all about exercise and movement. The NIH also promotes the benefits of quality sleep for improving mental and physical health. To that end, Edited expects loungewear to continue to grow in 2021. Activewear brands are stocking 14 percent more loungewear products compared to a year ago, Marci states, as consumers seek cozy pieces for resting and recovering from their workouts. Further, in a separate analysis, Edited states that a report by Technavio estimates the sleep and loungewear market is poised to grow by $19.5 billion from 2020-to-2024.

It also doesn’t hurt to have good sheets while striving for better sleep. The Sleep Foundation rated the best sheets of 2021, keeping in mind different sheets can have a big impact on comfort and quality of sleep. Its “Best Overall” pick went to Brooklinen Classic Percale Sheets, made of 100 percent long-staple cotton.

The year ahead will continue to challenge brands, retailers, and consumers. But YPulse, the research consultancy for Gen Z and Millennial marketing, said younger generations were already making better choices and showing an increased interest in health prior to the pandemic. Although COVID-19 brought about less-than-healthy eating and drinking patterns, the firm believes it will be short-lived.

“Expect the year ahead to include a refocus on wellness,” YPulse states. “We also expect that the definition of ‘wellness’ is going to be broadened in the coming months. With inclusivity and mental wellness already major priorities for young consumers, it’s likely that they will embrace the idea that a narrow definition of wellness isn’t healthy and be rethinking what it means in 2021.”