By now, a lot of Americans have ventured back to stores and malls, but it doesn’t take long to notice everything is just a little bit different. Or maybe a lot different, depending on the state or the retailer. There’s limited occupancy at some stores, closed fitting rooms, floor markings that designate where to stand when checking out and Plexiglas at registers. Contactless deliveries have also ballooned, and curbside pickup isn’t just for dining. Some of these changes may be long term, and others may disappear when the virus does. In the meantime, stores have to figure out how to minimize COVID-19’s impact on shoppers — and their own associates.[quote]

Of course, wearing a mask has been a point of debate, but in mid-July the National Retail Federation issued a statement encouraging retailers to adopt a nationwide policy that requires customers to wear face coverings or masks to protect the health of both customers and store associates. Matthew Shay, president, told Fox Business the NRF is looking at the economic factors involved, as merchants don’t want to suffer the effects of another lockdown. He said masks make sense as it has been reported that it could be 18-to-24 months before multiple vaccines are in the marketplace.

“Until then, I think we all need to recognize, as much as we don’t want to, that we need to do some things differently and this is one piece of that kind of changed behavior.”

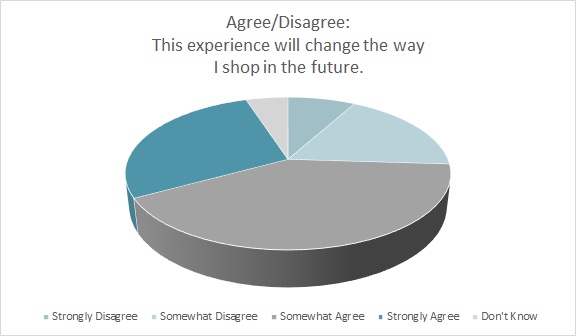

Nearly 7 in 10 shoppers (68 percent) say the coronavirus experience will change the way they shop, according to Cotton Incorporated’s 2020 Coronavirus Response Survey (Wave 2, April 27-30). Gen Z consumers (64 percent) were less concerned than Millennials (70 percent) and Gen Xers (71 percent). But each generation overwhelmingly expected the virus to have an effect.

Before the pandemic, just 30 percent of consumers said they often shopped online, according to the Coronavirus Response Survey research. Most respondents (55 percent) said they “sometimes” did, 14 percent said they rarely engaged in ecommerce, and 2 percent said they did not shop online.

But after COVID-19 started spreading across the nation, 44 percent of shoppers said they shopped online more than before, according to the Coronavirus Response Survey research. Nearly 6 in 10 shoppers (57 percent) say they feel it’s safer to purchase items online rather than shop in a physical store.

A McKinsey & Co. survey found that post-pandemic, apparel executives expect up to a 13 percent increase in online penetration. The firm says, “Unless stores offer consumers a compelling value proposition, store traffic — which was already thinning in pre-coronavirus times—will slow to a trickle. Consumers are now accustomed to staying home for weeks at a time and buying a wide range of products online. In the future, they won’t visit stores unless retailers give them good reason to.”

The need to create a more engaging in-store experience is definitely urgent. The Coronavirus Response Survey finds almost one-quarter of consumers (23 percent) say they will have a stronger preference for online clothes shopping as stores reopen and the pandemic passes.

McKinsey says retailers need to redefine the role of the store, offering unique customer experiences instead of simply serving as transactional venues. This includes delivering a “superior product discovery experience” and providing access to exclusive merchandise. Retailers also need to offer omnichannel fulfillment, especially since consumers want contactless purchase options like curbside pickup and buy online/pickup in store (BOPIS).

Additionally, McKinsey suggests retailers invest in training and equipping store associates to engage with customers online, so they can continue the in-store experience by interacting with them post-purchase. Finally, the firm says if store associates have access to customer data that’s generated both in-store and online, they can tailor customer interactions accordingly, and give shoppers personalized attention at brick-and-mortar locations.

Consumers that don’t want to linger might appreciate that kind of attention when they get back to the stores. Some of the top items they plan on purchasing in physical retail locations include casual shirts (25 percent) and denim jeans (24 percent), according to Coronavirus Response Survey research. That’s followed by intimate apparel such as underwear and bras (23 percent), casual pants (21 percent), and activewear (20 percent).

Coresight Research’s Steven Winnick, senior analyst, said during a recent webinar discussion that retail sales saw a 9 percent increase year-over-year for the month of June, which could be chalked up to pent-up demand from March and April. However, he said last month clothing retailers experienced a 24 percent decrease and department stores saw a 12 percent decline.

Ethan Chernofsky, vice president of marketing at Placer.ai, a foot traffic analytics platform, spoke with Winnick during the online discussion. Chernofsky says retail will see a lot of movement over the coming months, as outdoor shopping centers try to pull indoor stores to their plazas. Then, because enclosed malls will have more space open up, the opportunity will present “for brands that were either not offline at all or primarily oriented toward outdoor centers to test out different types of formats within an indoor environment.”

“This is a really exciting moment happening now, and ultimately, there is a greater likelihood that this diversification of what exists within an outdoor shopping center could create a better retail environment,” Chernofsky says. He says shoppers have basically been bored with the mall status quo because the stores are all the same. “This idea that we should now have malls with fundamentally different vibes, experiences and retailers within them is going to create a more diversified environment. I can go to one mall one weekend and the next, have an essentially different experience that makes each one exciting and targeted toward a specific audience.

Over the next 6-to-12 months, Winnick says, outdoor centers will benefit from a 10 percent decrease in foot traffic at enclosed malls, as many consumers will be too fearful of shopping indoors.

Chernofsky says the mall sector will survive the pandemic, but it will look different.

“Some of the innovative ideas taking places in malls involve repurposing department centers to larger kinds of food and entertainment options and — my favorite — co-working within the mall,” he said. “If I have an audience that’s coming in daily in terms of coming to work, then I can be the place where they eat, the place where they exercise and the place where they pick up certain types of goods. I think this shift in mentality and miles is going to be hugely important.”

Chernofsky also says brands that “own their relationship with the customer” will come out on top.

“Puma is launching its own real offline presence,” he enthused. “You look at Nike announcing 200 more stores, Levi’s announcing 100-plus more stores as wholesale declines. Look at how successful some of these companies have been. The idea that we expect that to stop because of COVID is problematic at best. I think the higher likelihood is that we’re going to see a unique environment created, where real estate costs drop, because a lot of brands will close and space will open up. As a result, whether it’s launching through companies like Neighborhood Goods or having their own locations, this is a trend we expect to continue and pick up in pace.”