It seems there was more than a little Christmas magic this past holiday season, as sales surpassed expectations and left many brands and retailers with something of a gift as the New Year kicks off.

U.S. year-end holiday sales rose 4.9 percent compared with the same period last year, according to Mastercard SpendingPulse. It was the largest year-over-year increase Mastercard tracked since 2011. Pre-season, the National Retail Federation (NRF) predicted holiday sales to increase from 3.6-to-4 percent. And the International Council of Shopping Centers (ICSC) expected growth of 3.8 percent.

Mastercard added that online sales increased 18 percent over last year. And foot traffic saw a healthy jump on Super Saturday, according to ShopperTrak — up 20 percent, which helped add to store coffers late in the holiday game.

Thanksgiving Day through Cyber Monday remained a hot shopping period, as the NRF and Prosper Insights & Analytics reported more than 174 million Americans shopped both in-store and online during the five-day holiday weekend — eclipsing the estimated 164 million from an earlier survey. And Super Saturday — the last Saturday before Christmas — proved to be a biggie, as 53 percent of consumers, or 126 million shopped that day.

Retail pundit Shelley Kohan, an assistant professor at the Fashion Institute of Technology, says the strong sales went beyond positive economic indicators and strong consumer confidence.

“From a consumer behavior perspective, the heavy and emotional impact of U.S. politics may have prompted shoppers to take a break from it all and enjoy family, shopping and fun,” Kohan relates. “Another contributor is the calendar of Christmas this year. With the holiday landing on a Monday, many people took advantage of family time for the three-day weekend.”

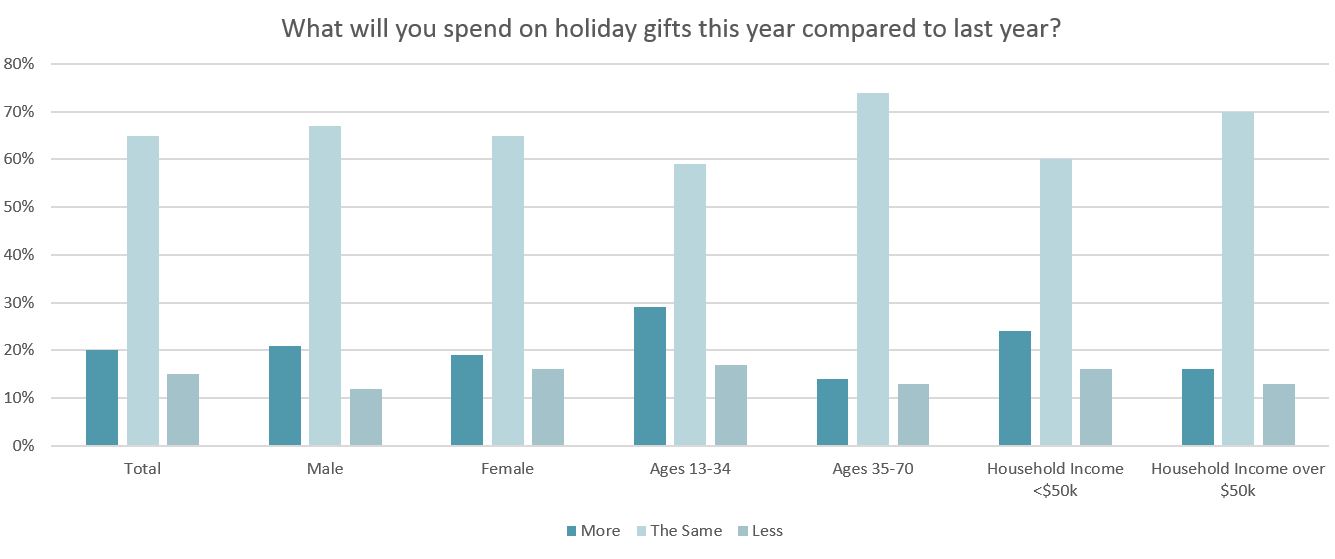

The increase in spending gibes with data from the Cotton Incorporated Lifestyle MonitorTM Survey, which found most consumers (85 percent), planned to spend at least as much as last year or more this holiday season.

For apparel brands, further good news was due to the fact that 84 percent of Monitor™ respondents planned to spend the same or more on clothing gifts, as well. Mastercard reported clothing and department stores saw “moderate gains” over the holidays.

JLL’s James Cook, director of retail research for the Americas, said another positive development was not seeing an increase in discounting. “But I do think we saw more items that were priced correctly from the beginning, meaning pretty low profit margins that were hopefully made up for in volume.”

Stores that did well not only priced product correctly early on, but replenished quickly and swiftly delivered to the consumer.

“Retailers have had a long learning curve,” Cook says. “For instance, it’s been fits and starts for traditional retail to get things like click-and-collect right. In the past they’ve been clunky and inefficient. But with experience, they’re getting better with tracking inventory in stores, so in-store fulfillment is better. In previous seasons, some retailers would launch in-store fulfillment but when went to fill the order, they couldn’t find the item because they couldn’t track inventory the way they needed to. So that’s getting better.”

It was vital that stores became more adept at the “buy online, pick-up in-store” option, as 3 in 5 online holiday shoppers said they planned to take advantage of that this past holiday season, according to Monitor™ data. And among those that planned to shop in-store, 79 percent said they typically plan their holiday gifts before they even go shopping, and 80 percent said they expect a retailer to have the same products in-store as they do online.

Kohan said retailers worked really hard to make sure past retail “pain points” remained in past.

“With a focus on synergistic strategies between online and brick-and-mortar, coupled with infrastructure work to improve supply chain efficiencies, retailers provided a more measured approach to the season,” she states. “With that said, the consumer attitude and external economic factors always play a starring role in the holiday sales results. The strong sales results are a combination of both.”

Strong jobs reports and consumer confidence heading into the season led to generally happy retail holidays. But during December, job growth fell below expectations, reaching 148,000 as opposed to the expected 180,000. And consumer confidence actually dipped to 122.1 in December from 128.6 in November, according to the Conference Board, a decrease analysts contributed to concern about the overhaul in the U.S. tax code.

Additionally, not all season-ending retail news was positive: While Macy’s had a 1 percent increase for the season, the company reported comp store sales declined by 2.4-to-2.7 percent and total revenue was expected to decrease by 3.6 to 3.9 percent. And, despite high hopes, JC Penney reported a disappointing holiday. Sales both online and in stores decreased -0.8 percent.

The competition for all stores is the now-ubiquitous Amazon. To keep up, stores had to employ more behind-the-scenes strategy than ever.

“Anecdotally, I heard about ecommerce under-promising and over-delivering and that went a long way to keeping people happy,” Cook says. “Ecommerce was successful at offering the public what they wanted at prices they could afford and maintaining proper levels of inventory. They did a great job on delivery. I monitor everything and I didn’t see high levels of disappointment anywhere.”

Kohan says retailers found their flow between ecommerce and traditional locations.

“Retailers used online to drive brick and mortar and vice versa,” she says. “They did a better job of controlling inventory, starting with an edited selection going into the season, and controlling supply and distribution of product going into the stores. Through data analytics, stores were able to dive down to get details about what their assortments should be right down to individual stores — even units just five miles apart. You think of all the IT systems behind the scenes that need to execute perfectly and it’s really hard. But it will only get better going forward.”