Environmental activism among consumers has steadily progressed due to more individuals adopting eco-friendly habits.  Consumers’ eco-sensitive attitudes and behaviors can be understood as a form of enlightened self-interest. More than two out of three consumers (70%) agree that they are happy to be environmentally-friendly as long as it saves them money. Financial incentives can also play a significant role in shoppers’ decisions to purchase apparel. More than 8 out of 10 consumers (86%) say that knowing clothing features and care factors could ultimately save them money is very influential in their decisions to purchase.

Consumers’ eco-sensitive attitudes and behaviors can be understood as a form of enlightened self-interest. More than two out of three consumers (70%) agree that they are happy to be environmentally-friendly as long as it saves them money. Financial incentives can also play a significant role in shoppers’ decisions to purchase apparel. More than 8 out of 10 consumers (86%) say that knowing clothing features and care factors could ultimately save them money is very influential in their decisions to purchase.

Although consumers express more concern about increasing prices at retail than about environmental and social issues, more than half (51%) describe themselves as “green consumers.” Shoppers’ confusion about marketing terms used to describe environmentally-friendly apparel, willingness to trust eco-friendly claims, and ability to minimize their clothing’s environmental footprint continue to represent areas of challenge and opportunity. The latest findings from Cotton Incorporated’s 2013 Environment Survey reveal that efforts to influence shoppers toward more eco-friendly behaviors could be bolstered by attention to the economic and sustainability advantages that they seek.

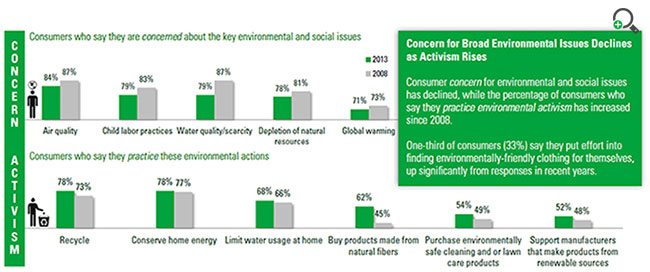

ACTIVISM TRUMPS CONCERN

Consumers’ environmentally-conscious actions tend to focus on areas that they have some perceivable sense of control, impact, or direct financial savings. Consumers indicate that their participation in eco-friendly habits such as recycling, turning off lights to conserve energy, and using less water, has steadily increased. In contrast, consumer concern about global environmental and social issues such as air quality, water quality/scarcity, and global warning has decreased, compared to six years ago. In regards to buying clothing, environmental-friendliness is still not a primary purchase driver for consumers, but more than two-thirds of shoppers (70%) would be bothered if they found out an item of clothing that they purchased was produced in  a non-eco-friendly way.

a non-eco-friendly way.

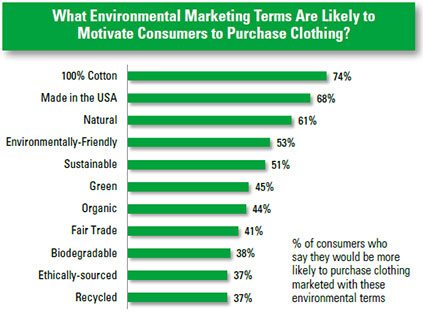

When shopping for environmentally-friendly products, more consumers read labels as they buy food or infant care products than when they purchase apparel (62% and 48%, respectively). To determine if a clothing item is environmentally-friendly, consumers study the fiber content label (45%), followed by the garment hang-tag (38%), and the packaging (34%). When asked, consumers say that “100% cotton” and “made in the USA” are most likely to influence their apparel purchase decisions, compared to terms such as “natural,” “sustainable,” or “environmentally-friendly.”

ECONOMICS OF ECO-FRIENDLY APPAREL

Consumers convey attitudes and exhibit behaviors that indicate a strong connection between their economic concerns and their decisions to purchase eco-friendly apparel. More than 6 out of 10 consumers (61%) agree that due to the current economic situation, they are less likely to pay more for eco-friendly clothing. However, buying locally has gained momentum as a national movement and 78% of consumers say that knowing a clothing item would support U.S. jobs or the economy would be very influential in their ultimate decision to purchase. Notably, consumer concern about products being made outside of the U.S. has increased to 68%, up from 65% in 2012.

Consumers believe that domestically manufactured clothing is better for the environment than apparel made overseas. Half of consumers (50%) think that clothing imported from other countries is less eco-friendly than clothing made in the USA. Consumers say the primary reasons that products manufactured in the U.S. are more environmentally-friendly is due to domestic regulation and environmental protection laws that other countries may not have or do not enforce. For American consumers, buying domestically manufactured clothing satisfies their desire to act in eco-friendly ways and to support the national economy.

due to domestic regulation and environmental protection laws that other countries may not have or do not enforce. For American consumers, buying domestically manufactured clothing satisfies their desire to act in eco-friendly ways and to support the national economy.

DUAL VIEWS ON SUSTAINABILITY

While consumers have a better understanding of the terms “environmentally-friendly” and “natural” when referring to clothing, they do not clearly understand the term “sustainable.” When thinking about clothing, over half of shoppers (51%) say sustainable refers to the durability or longevity of apparel and 14% indicate that they do not know what “sustainable” clothing means. Only 22% of shoppers associate the word “sustainable” with the environment, when considering their clothing. The environmental factors that consumers relate to the term are “does not harm the environment” and “made from renewable resources.”

Consumer perceptions that sustainability relates to the lifespan of their clothing points to concerns that they have about apparel quality and a possible diminishing attraction to disposable inexpensive clothing. Embracing sustainability in terms of clothing longevity from a consumers’ perspective and environmental responsibility from an industry standpoint could be gaining headway1. The long-term financial costs of fast fashion for consumers, coupled with the potential detrimental environmental impacts, could accelerate the expansion of sustainable apparel offerings. Connecting with consumers to help reduce the environmental footprint of apparel can be aided by communicating and demonstrating clear financial savings and sustainability advantages.

ABOUT THE RESEARCH

Cotton Incorporated’s Environment Survey is an annual nationwide study of consumers ages 13-54, who identified themselves as their household’s primary or secondary decision-maker for clothing purchases. The survey, conducted via the internet, by Bellomy Research, Inc., included a sample that was 60% female and 40% male, and was representative of the U.S. population based on ethnicity, income, education, and geography.

External Source: Forbes.com